INTRODUCTIONAs the Internet and World Wide Web become commonly use in every household in recent years,

it is obvious that e-commerce, a branch of technology and business are incredibility rising25.

There are more and more E-commerce sites available on the Internet, including the few famous

sites such as Amazon, eBay, and Dell. Many major industries have noticed the significant rise of

the Internet, so they started selling products through their websites and even have delivery

services for customers. Therefore, it is possible to buy everything through the Internet nowadays.

You can buy your computer from Dell’s website, do your grocery shopping through Loblaws’s

website, buy your clothes through major clothing industries like Guess or Bluenotes, and even

buy your books and electronic products through Future Shop or Best Buy. But industries often

perform delivery with extra charge, or simply include the charge on the price listed. E-commerce

had become more popular globally, and there are some issues, challenges, and opportunities that

need to be identified using the e-commerce sites. There are some aspects for successful

globalized e-commerce sites, in which they have multi-lingual support, multi-language customer

care, international shipping, and other aspects. Also, this essay would talk about how ecommerce

transactions works along with the changes and the benefits that have received by

using the e-commerce sites

E-COMMERCE

Electronic commerce, in a broad sense, is the use of computer networks to improve

organizational performance. Increasing profitability, gaining market share, improving customer

service, and delivering products faster are some of the organizational performance gains possible

with electronic commerce26. Electronic commerce is more than ordering goods from an on-line

catalog. It involves all aspects of an organization’s electronic interactions with its stakeholders,

the people who determine the future of the organization. Thus, electronic commerce includes

activities such as establishing a Web page to support investor relations or communicating

electronically with college students who are potential employees. In brief, electronic commerce

involves the use of information technology to enhance communications and transactions with all of an organization’s stakeholders. Such stakeholders include customers, suppliers, government

regulators, financial institutions, mangers, employees, and the public at large.

According to Beekman, "Electronic Commerce, or e-commerce, is the process of sharing

business information, maintaining business relationships and conducting business transactions

through the use of telecommunications networks.

Advantages of E-Commerce

advantages. Firstly e-commerce lowers the cost for people who wish to become an online

merchant. A modest investment in personal computer and internet connection cost can start a

business online. Through the World Wide Web, you can access e-commerce sites from different

countries. For a global e-commerce site, there are concerns about language barrier, tariff of the

country on shipments, currency rate, and other many concerns. Dell computer corp. is a good

example of a successful global e-commerce business. David Dix, the Global Internet PR

manager says that when Dell computers went global, they tripled its sales on the Internet to 18

millions every single day. There are some aspects of the global e-commerce sites, in which they

have to convert their sites to fit local languages, provide multi-language customer service,

convert their sites to fit culturally relevant content, and provide currency checkers for selling

products oversea. As e-commerce is accessible on a global scale, it can surely attract more

international customers to the site. The IDC report pointed out that there are about 57 million

web users just in Japan alone. According to Forrester, Japan could possibly produce a revenue of

$1.6 trillion for the online shopping. Think about how many people are in the world? The global

nature of e-commerce can definitely create a new economy.

Some of the advantages of e-commerce are:

− E-commerce also makes findings a lot quicker and easier as say the shop is far away from

your house you can check if the product is available before you go and see it. Access and

availability are two main benefits.

− For suppliers, it's easier to source products from a wider base and as mentioned, for a

cheaper cost

− Saves cost in other administrative processes such as invoices can be sent online saving

mass amounts of paper

− it makes your business seem bigger than you really are because your market increases

− the ability to reply to customers and answer queries quicker and cheaper via email

definitely helps in sustaining the market and its customers

Many people doubt e-commerce benefits from developing countries. In fact, there are several

Challenges in E-Commerce

Although e-commerce is quite convenient, there are some issues that keep consumers away for

online shopping. Online fraud will be the most common issue for e-commerce. From conducted

researches, it was found that online credit card scams are 12 times higher than if a consumer

purchase the product in the store. As a result, consumers lack the confidence to shop online.

Harris Interactive says that approximate 70 percent of consumers worry about the transaction

being insecure online, and this lead to a $15 billion drop in online purchasing. Online commerce

sites should be really careful about the security of the transactions. Protect online privacy is a big

challenge for the commerce site. When you purchase on the Internet, first thing you need to do is

to create an account using your credit card number, address, name, birthday, and basically all

your information. Many consumers would fear that their private information would be given out

to strangers without any sign, and this would lead to consumers unwilling to give out information

on the Internet. The sites should post a privacy statement that clearly states how personal

information will be used and whether the information is going to be used beyond the transaction.

One of the surveys says consumers will leave the sites if the privacy policy is unclear. A

successful website should provide secure transaction for the consumers and protect consumer

privacy.

A variety of demographics are resistant to change or prefer to safeguard their personal

information. Although it seems hard to find fault in such a marvellous technology, there is a

significant market segment that is resistant to accept everything digital, with good reason. Many

people are quite hesitant about revealing personal credit information, to a company that exists in

a non-physical environment, in exchange for physical goods. For example, internet statistics

show that key segments of the population are still either not participating in e-commerce or

resistant to join the online community at all. “Globally, almost three-quarters (72 percent) of

respondents say they are concerned about online security, especially the potential misuse of their

credit cards”. However, many of these fears and misinterpretations are without warrant and are

based solely on rumour and media exploitation. “Only 1 percent of adults surveyed say they have

been the victim of online fraud and just 6 percent say they know of someone who has been”.

Consequently, e-commerce expansion has suffered, thereby limiting its appeal to those who view

the security technology trustworthy and reliable. A major challenge to toppling this myth has

been assuring users that their most private information will not be used by any third party to

target them with malicious or frivolous content.

Some of the disadvantages of E-Commerce are:

− It is hard to ensure that people will visit your site because there are millions of sites out

there-more difficult to reach the market directly.

− Most people tend to prefer shopping because they can physically try on everything and

know exactly what it looks like or touch or feel the product. the social and voyeuristic

aspect of shopping is more popular than E commerce hence one may not profit from E

commerce.

− The risk of fraud is always there, as online shopping can be dangerous and hence if

people don’t trust or are apprehensive of sending out credit card information, etc. they

may not shop online for less developed countries access to internet is either nil or slow,

so not everyone has equal access to the benefits of E commerce. Those companies may not be able to publicize or advertise themselves as much as those who have the money

and the infrastructure in their residing countries to do so.

E-COMMERCE BUSINESS MODELS

There are multiple types of sales scenario some of it are as follows:

a. Business-to-Consumer (B2C): In a Business-to-Consumer E-commerce environment,

companies sell their online goods to consumers who are the end users of their products or

services. Usually, B2C E-commerce web shops have an open access for any visitor and

user.

b. Business-to-Business (B2B): In a Business-to-Business E-commerce environment,

companies sell their online goods to other companies without being engaged in sales to

consumers. In most B2B E-commerce environments entering the web shop will require a

log in. B2B web shop usually contains customer-specific pricing, customer-specific

assortments and customer-specific discounts. There are several SaaS B2B eCommerce

platforms available, such as TradeGecko's B2B eCommerce Platform.

c. Consumer-to-Business (C2B): In a Consumer-to-Business E-commerce environment,

consumers usually post their products or services online on which companies can post

their bids. A consumer reviews the bids and selects the company that meets his price

expectations.

d. Consumer-to-Consumer (C2C): In a Consumer-to-Consumer E-commerce environment

consumers sell their online goods to other consumers. A well-known example is eBay.

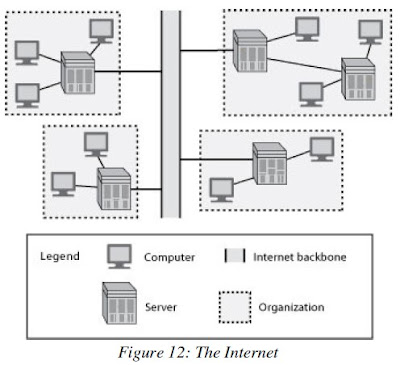

INFRASTRUCTURE

Electronic commerce is built on top of a number of different technologies28. These various

technologies created a layered, integrated infrastructure that permits the development and

deployment of electronic commerce applications.

National Information Infrastructure

This layer is the bedrock of electronic commerce because all traffic must be transmitted by one

or more of the communication networks comprising the national information infrastructure (NII).

The components of an NII include the TV and radio broadcast industries, cable TV, telephone

networks, cellular communication systems, computer networks, and the Internet. The trend in

many countries is to increase competition among the various elements of the NII to increase its

overall efficiency because it is believed that an NII is critical to the creation of national wealth.

Message Distribution Infrastructure

This layer consists of software for sending and receiving messages. Its purpose is to deliver a

message from a server to a client. For example, it could move an HTML file from a Web server

to a client running Netscape. Messages can be unformatted (e.g., e-mail) or formatted (e.g., a purchase order). Electronic data interchange (EDI), e-mail, and hypertext text transfer protocol

(HTTP) are examples of messaging software.

Electronic Publishing Infrastructure

Concerned with content, the Web is a very good example of this layer. It permits organizations to

publish a full range of text and multimedia. There are three key elements of the Web:

− A uniform resource locator (URL), which is used to uniquely identify any server;

− A structured markup language, HTML.

Notice that the electronic publishing layer is still concerned with some of the issues solved by

TCP/IP for the Internet part of the NII layer. There is still a need to consider addressability (i.e.,

a URL) and have a common language across the network (i.e., HTTP and HTML). However,

these are built upon the previous layer, in the case of a URL, or at a higher level, in the case of

HTML.

Business Services Infrastructure

The principal purpose of this layer is to support common business processes. Nearly every

business is concerned with collecting payment for the goods and services it sells. Thus, the

business services layer supports secure transmission of credit card numbers by providing

encryption and electronic funds transfer. Furthermore, the business services layer should include

facilities for encryption and authentication.

Electronic Commerce Application

Finally, on top of all the other layers sits an application. Consider the case of a book seller with

an on-line catalog (see Table 4). The application is a book catalog; encryption is used to protect a

customer’s credit card number; the application is written in HTML; HTTP is the messaging

protocol; and the Internet physically transports messages between the book seller and customer.

PAYMENT SYSTEMS

When commerce goes electronic, the means of paying for goods and services must also go

electronic29. Paper-based payment systems cannot support the speed, security, privacy, and

internationalization necessary for electronic commerce. In this section, we discuss five methods

of electronic payment:

− electronic funds transfer

There are four fundamental concerns regarding electronic money: security , authentication,

anonymity, and divisibility. Consumers and organizations need to be assured that their on-line

orders are protected, and organizations must be able to transfer securely many millions of

dollars. Buyers and sellers must be able to verify that the electronic money they receive is real;

consumers must have faith in electronic currency. Transactions, when required, should remain

confidential. Electronic currency must be spendable in small amounts (e.g., less than one-tenth of

a cent) so that high-volume, small-value Internet transactions are feasible (e.g., paying 0.1 cent

to read an article in an encyclopedia). The various approaches to electronic money vary in their

capability to solve these concerns (see Table 5).

Any money system, real or electronic, must have a reasonable level of security and a high level

of authentication, otherwise people will not use it. All electronic money systems are potentially

divisible. There is a need, however, to adapt some systems so that transactions can be automated.

For example, you do not want to have to type your full credit card details each time you spend

one-tenth of a cent. A modified credit card system, which automatically sends previously stored

details from your personal computer, could be used for small transactions.

The technical problems of electronic money have not been completely solved, but many people

are working on their solution because electronic money promises efficiencies that will reduce the

costs of transactions between buyers and sellers. It will also enable access to the global marketplace. In the next few years, electronic currency will displace notes and coins for many

transactions.

Electronic Funds Transfer

Electronic funds transfer (EFT), introduced in the late 1960s, uses the existing banking structure

to support a wide variety of payments. For example, consumers can establish monthly checking

account deductions for utility bills, and banks can transfer millions of dollars. EFT is essentially

electronic checking. Instead of writing a check and mailing it, the buyer initiates an electronic

checking transaction (e.g., using a debit card at a point-of-sale terminal). The transaction is then

electronically transmitted to an intermediary (usually the banking system), which transfers the

funds from the buyer’s account to the seller’s account. A banking system has one or more

common clearinghouses that facilitate the flow of funds between accounts in different banks.

Electronic checking is fast; transactions are instantaneous. Paper handling costs are substantially

reduced. Bad checks are no longer a problem because the seller’s account balance is verified at

the moment of the transaction. EFT is flexible; it can handle high volumes of consumer and

commercial transactions, both locally and internationally. The international payment clearing

system, consisting of more than 100 financial institutions, handles more than one trillion dollars

per day.

The major shortfall of EFT is that all transactions must pass through the banking system, which

is legally required to record every transaction. This lack of privacy can have serious

consequences. Cash gives anonymity.

Digital Cash

Digital cash is an electronic parallel of notes and coins. Two variants of digital cash are presently

available: prepaid cards and smart cards. The phonecard, the most common form of prepaid card,

was first issued in 1976 by the forerunner of Telecom Italia. The problem with special-purpose

cards, such as phone and photocopy cards, is that people end up with a purse or wallet full of

cards. A smart card combines many functions into one card. A smart card can serve as personal

identification, credit card, ATM card, telephone credit card, critical medical information record

and as cash for small transactions. A smart card, containing memory and a microprocessor, can

store as much as 100 times more data than a magnetic-stripe card. The microprocessor can be

programmed.

The stored-value card, the most common application of smart card technology, can be used to

purchase a wide variety of items (e.g,. fast food, parking, public transport tickets). Consumers

buy cards of standard denominations (e.g., USD 50 or USD 100) from a card dispenser or bank.

When the card is used to pay for an item, it must be inserted in a reader. Then, the amount of the

transaction is transferred to the reader, and the value of the card is reduced by the transaction

amount.

The problem with digital cash, like real cash, is that you can lose it or it can be stolen. It is not as

secure as the other alternatives, but most people are likely to carry only small amounts of digital

cash and thus security is not so critical. As smart cards are likely to have a unique serial number, consumers can limit their loss by reporting a stolen or misplaced smart card to invalidate its use.

Adding a PIN number to a smart card can raise its security level.

Twenty million smart cards are already in use in France, where they were introduced a decade

earlier. In Austria, 2.5 million consumers carry a card that has an ATM magnetic stripe as well as

a smart card chip. Stored-value cards are likely to be in widespread use in the United States

within five years. Their wide-scale adoption could provide substantial benefits. Counting,

moving, storing and safeguarding cash is estimated to be 4 percent of the value of all

transactions. There are also significant benefits to be gained because banks don’t have to hold as

much cash on hand, and thus have more money available for investment.

e-cash

Digicash of Amsterdam has developed an electronic payment system called ecash that can be

used to withdraw and deposit electronic cash over the Internet. The system is designed to provide

secure payment between computers using e-mail or the Internet. Ecash can be used for everyday

Internet transactions, such as buying software, receiving money from parents, or paying for a

pizza to be delivered. At the same time, ecash provides the privacy of cash because the payer can

remain anonymous.

To use ecash, you need a digital bank account and ecash client software. The client is used to

withdraw ecash from your bank account, and store it on your personal computer. You can then

spend the money at any location accepting ecash or send money to someone who has an ecash

account.

The security system is based on public-key cryptography and passwords. You need a password

to access your account and electronic transactions are encrypted.

Credit card

Credit cards are a safe, secure, and widely used remote payment system. Millions of people use

them every day for ordering goods by phone. Furthermore, people think nothing of handing over

their card to a restaurant server, who could easily find time to write down the card’s details. In

the case of fraud in the U.S., banks already protect consumers, who are typically liable for only

the first USD 50. So, why worry about sending your credit card number over the Internet? The

development of secure servers and clients has made transmitting credit card numbers extremely

safe. The major shortcoming of credit cards is that they do not support person-to-person transfers

and do not have the privacy of cash.

Google Wallet

Google Wallet, now renamed as Google payment is a smart phone app released by Google in

September 201130. Google Wallet hopes to help consumers by consolidating the contents of their

wallets (credit cards, debit cards and gift cards) into their phones, adding convenience and

reducing clutter. Google Wallet is installed as an app that takes advantage of NFC technology,

allowing consumers to pay by simply tapping their phones on a terminal. Although technically NFC is capable of processing peer to peer transactions (for example, by bumping phones),

neither Google nor its main competitor have pursued that market yet.

One difference between Google Wallet and ISIS (mobile payment network initiated by AT & T

mobility, T- Mobile USA and Verizon) is in the revenue model. Whereas ISIS has aspirations of

charging major credit card networks to use its ISIS system through direct fees or taking a portion

of interchange, Google Wallet plans to make money by selling targeted advertisements.

However, since Google Wallet and ISIS are both in early stages and currently focused on

acquiring market share, no definite revenue model has been adopted yet – some reports speculate

that Google Wallet may adopt a model more based on transaction fees, and others claim that they

will use their relationship with Bancorp to extract an interchange fee.

Post a Comment